Student

Finance

A new way to fund your future

StepEx provides funding based on your financial future, not your past. We help cover the cost of your course fees with various plans that work for you and remain affordable in the long term.

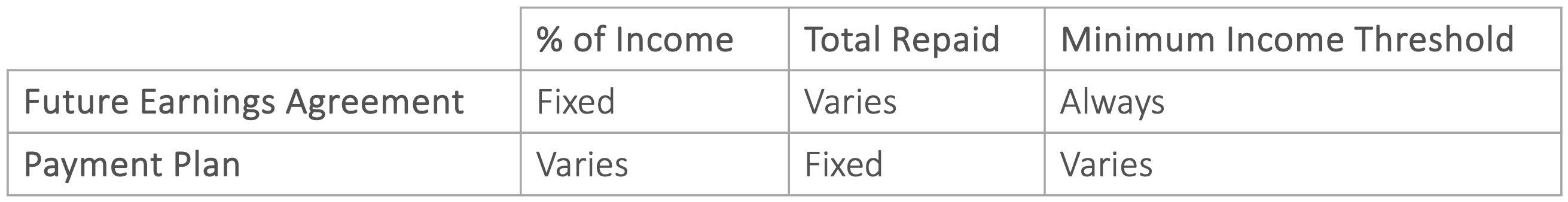

We have two products to help assist you with your tuition fees:

- Future Earnings Agreements (FEAs)

- Payment Plans

FEAs

StepEx FEAs allow universities and bootcamps to waive tuition fees in return for a percentage of your gross income.

Good to know:

- StepEx is the first regulated provider of FEAs in the UK.

- You only make repayments when you earn above a minimum income threshold.

- The amount you pay for your course depends on your actual earnings.

- If your salary is less than expected, then you repay less.

- If your salary is more than expected, then you repay more.

- The total amount owed is capped.

- Earn more and you can repay the loan earlier.

- Earn less and extra payments are not needed.

Payment Plans

StepEx Payment Plans allow you to split your tuition costs over several monthly repayments, without any added interest.

Good to know:

- Your monthly repayment amounts are fixed and the total amount owed is capped.

- For some products, you only make repayments when you earn above a minimum income threshold.

- For some products, you start repayments after graduating from your course.

Student success stories

Representative Example: FEA

- Jane needs £10,000 to finish her MBA.

- StepEx offers her an FEA of £10,000, with a maximum repayment cap of £20,000 and a minimum income threshold of £30,000.

- In 2025, Jane qualifies and begins her new job, earning more than the minimum income threshold after graduating.

- Jane repays 10% of her gross income over 5 years to pay her fees.

- If Jane was earning more, her repayments would end once a total of £20,000 is repaid (maximum repayment cap).

- If Jane was earning less or was unemployed, the agreement will end after 5 years of repayments, or after 10 years have passed since the start of the agreement.

2025

£30,000

£3,000

2026

£33,000

£3,300

2027

£37,000

£3,700

2028

£41,000

£4,100

2029

£45,000

£4,500

Representative Example: Payment Plan with a Minimum Income Threshold

- Jane needs £10,000 to finish her MBA.

- StepEx offers her a Payment Plan of £10,000, with a minimum income threshold of £30,000.

- In 2024, Jane qualifies and begins her new job.

- As Jane is earning below the minimum income threshold in 2024, she does not need to start repaying.

- In 2025, Jane earns enough to start repayments.

- If Jane instead went for a Payment Plan without a minimum income threshold, her repayments would have started in 2024 regardless of her employment or income status.

2024

£0

£0

2025

£30,000

£2,500

2026

£33,000

£2,500

2027

£37,000

£2,500

2028

£41,000

£2,500

Representative Example: Payment Plan

- Jane needs £10,000 to finish her MBA.

- StepEx offers her a Payment Plan of £10,000.

- Repayments for this product start after the contract is signed. As there is no Minimum Income Threshold, repayments begin while Jane studies her course.

- In 2025, Jane begins her new job.

- If Jane went for a Payment Plan with a minimum income threshold, her repayments would have started in 2025.

2024

£0

£2,500

2025

£30,000

£2,500

2026

£33,000

£2,500

2027

£37,000

£2,500

Probability of Earnings while in an FEA

A Future Earnings Agreement (FEA) is based on what you earn, so the amount you repay is not fixed. It does not have a fixed APR or interest rate like traditional debt products.

So if you earn more than expected, the amount you repay will be higher. If you earn less than expected, the amount you repay will be lowered.

Based on historic earnings data, the provides an indication of how much you are likely to repay in total for a typical course.

For example, if you borrowed £10,000 and repaid £12,000 over a 5-year period, you would have repaid 120% of the amount you borrowed.

Less than 115% of the amount borrowed

14.9%

Less than 130% of the amount borrowed

51.0%

Greater than 160% of the amount borrowed

10.6%

How it works

Apply online

Receive funding

Start studying

Repay

Are you eligible?

Check the following requirements before you apply:

- Over 18

- Pass a background check

- No history of financial crime

- Valid Passport

Ready to apply for a StepEx Future Earnings Agreement?

People often ask

What is a Payment Plan?

A Payment Plan is a way of deferring some or all of your education tuition. It enables you to start an education programme even if you don’t have all the money to pay upfront. Instead, you split the cost of the course into monthly repayments to be made at a later date without any added interest.

Are Payment Plans like a bank loan?

Who is eligible for financing from StepEx?

To be eligible you must meet the requirements on our Apply Now page and any quote from us will be subject to our assessment of your circumstances.

How do I sign up for a StepEx agreement?

If I already have a loan can I still apply for an FEA?

Do I have to pay anything upfront?

This depends. Some education providers may require you to make a course reservation fee payment to secure your place on the programme. You may also need to pay an application fee to StepEx.

What happens if I leave my course early?

For how long will I have to make monthly repayments?

This also depends on the education provider and your chosen course of study. Typically it will consist of 24, 36, or 48 repayments.

When do I have to start repaying?

This depends. Typically it will either be: one month after you sign your contract; the month you start your course; or the month after you finish your course. Check the landing page for the education programme you wish to pursue on the StepEx site for specific details of the offer.

All FEAs and some Payment Plans also have a minimum income threshold: you only start repaying after your income meets a certain amount.

Can I repay my FEA or Payment Plan early?

Your StepEx loan may be repaid at any point by paying the maximum payment cap that will be stated in your contract. For Payment Plans, this will be your total original loan amount. For FEAs, this can be higher.

Why StepEx?

Regulated by the Financial Conduct Authority (FCA)

We’re fully regulated and compliant with the FCA to ensure our customers are treated fairly and have full transparency of relevant information.

Our Future Earnings Agreement is a first-of-its-kind product

Similar products, such as Income Share Agreements, exist in other parts of the world – but they’re unregulated and don’t offer consumer protection.

Partnered with top qualification providers in the UK

Our trusted partners are top qualification providers seeking to make their best courses affordable to the less wealthy majority.

Ready to step up with StepEx?

If you think you’re eligible, apply now or find out more.

Got a question? See our FAQs.